About Eazyshow

Founded in 2020, Eazyshow revolutionizes how Latin American financial institutions engage customers by seamlessly integrating live video interactions and now also with AI-driven automation. Our proven white-label platform empowers banks and fintech companies to deliver efficient, scalable, and humanized customer support while maintaining strict compliance and security standards.

Leveraging IBM WatsonX AI, Eazyshow bridges digital efficiency with human empathy. Our solution delivers personalized AI support through text, audio, and visual avatars, with seamless escalation to live video agents when needed. From loan applications to account openings and credit card issuance, Eazyshow streamlines financial services across mobile, desktop, and kiosk channels. All interactions are encrypted, archived, and auditable, ensuring secure compliance with global financial regulations.

Accelerate Banking Efficiency with Video Chat Engagement and AI Automation

Financial institutions face mounting pressure: customers demand instant, personalized support while regulatory requirements mandate secure, auditable interactions—all while reducing operational costs.

Eazyshow eliminates costly branch visits and field agent deployments by enabling secure remote account openings and verifications through dedicated video chat with specialized tools. Our platform combines AI automation with live video—delivering instant AI support through text, audio, and avatars, then escalating to video agents for identity verification and complex transactions. Eazyshow integrates seamlessly with existing CRM systems, APIs, and business applications.

Built for banking and fintech, every interaction is encrypted and compliant with global financial regulations, specifically Latin American standards—enabling institutions to dramatically reduce costs while delivering secure, humanized service from anywhere.

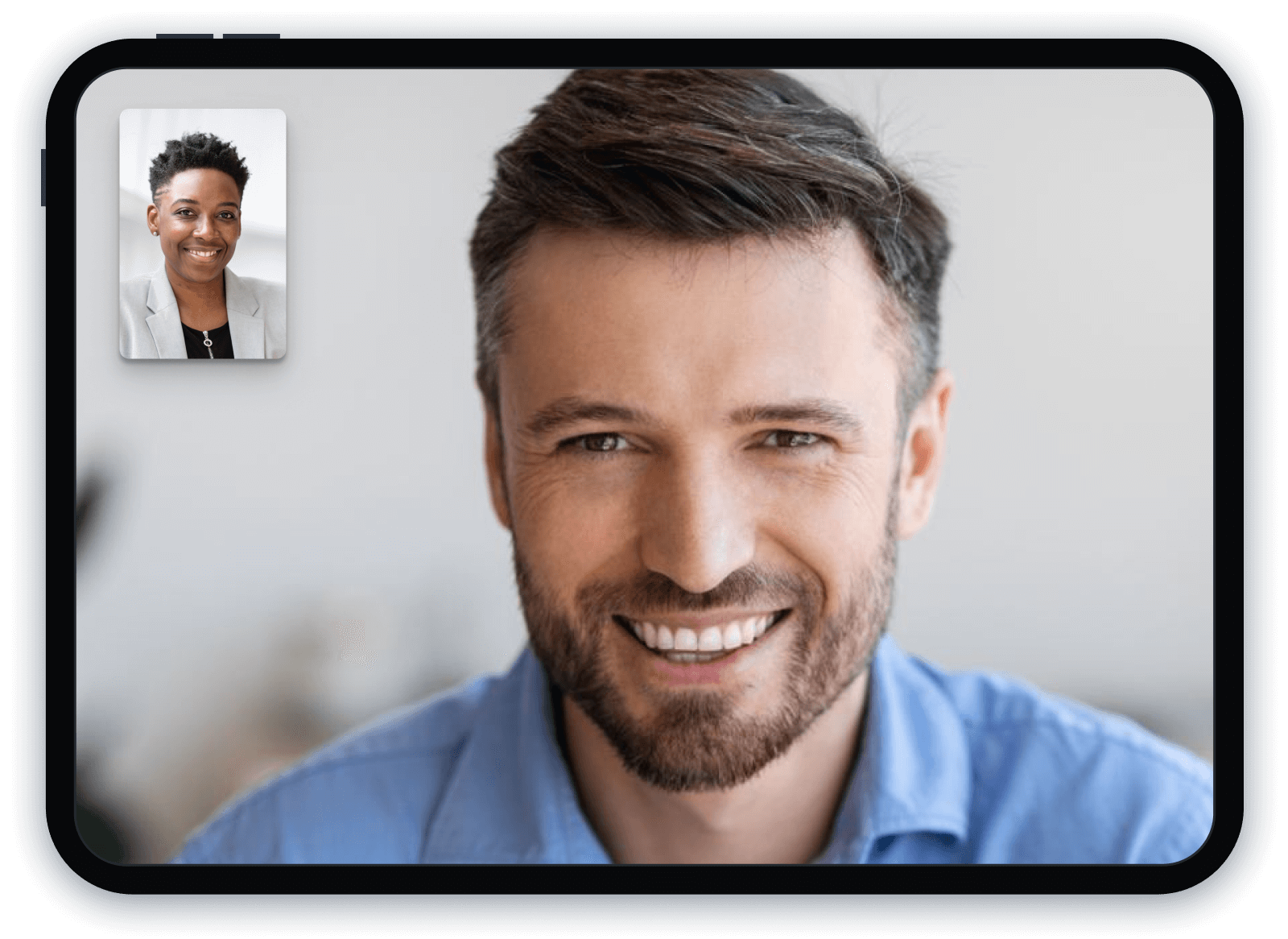

Superior customer experience

Using our instant video chat solution, our clients experience higher customer conversion rates, quicker completion of sales funnels, and an improved and seamless customer service experience.

Enhanced professional interactions

A customer clicks on a live help button, and a sales or service agent answers the customer’s “call” and initiates a video chat session. Customer and agent can also use screen share, document share, co-browsing functionalities, and use ID verification tools, as well as verify client location utilizing geolocation capabilities. These features and tools “mimic” in-person experience.

Enhanced professional interactions

Leadership team

Hannah Lis

Chairman

Yuval Moed

CEO & co-founder

Evgenii Belitckii

CTO & co-founder