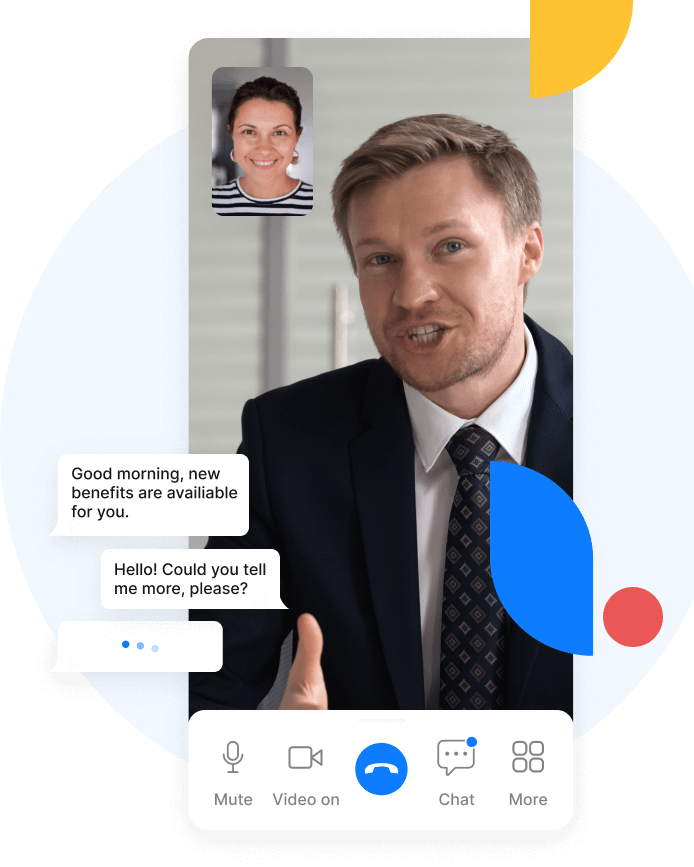

Increase productivity through 1 on 1 video chat

Eazyshow helps banks and financial institutions expand their business remotely by using dedicated and embedded video chat solutions. It allows banks to efficiently and effectively serve their customers while offering a variety of services remotely that weren’t possible before. The solution allows remote live interaction while complying with strict regulatory requirements. This results in exceptional customer service and increased sales as the bank can:

- Instantly communicate with customers using live text, voice, and video on any device, app or website.

- Collaborative browsing of website pages (both in front and behind a login) to better resolve issues.

- Provide complete remote support in the completion of loan applications remotely.

Verify identity and record session securely

One key component of offering remote financial services is the ability to verify someone’s identity. Eazyshow enables online Know Your Customer (KYC) to verify the identity of customers before they provide service. Once verification is complete, financial institution agents can work with customers to do everything from filling out loan applications for loans remotely to processing applications and providing a loan acceptance all while interacting directly from the institution’s website or app. The entire interaction is recorded, encrypted and only special authorized personnel of the bank or regulators can decrypt the recorded sessions for regulatory and audit purposes.

Increase efficiency in the on-boarding process

Eazyshow technology enables financial institutions to verify the existence of a business and its location without having to send an in-person representative. The verification is securely recorded and archived. With Eazyshow, businesses can open new bank accounts much faster.

Eazyshow is simple to implement, and entirely browser-based, no downloads or installations are required.

Our advantages

Efficient and personal service

5 sec

300%

25%

More about remote video chat support